For years, we Canadians have been conditioned to think about retirement in terms of planning and saving. But it’s a new reality out there. Today, there are more factors to consider, and more products at our disposal. The 4 facts below can affect the way your clients prepare for the day they step away from work for good. Sharing these with them will not only serve to deepen your client/broker relationship; it will also demonstrate how you continue to have their best interests at heart.

-

4 things your clients should know about their retirement

-

How to stay relevant in 2019: tips to help your email stand out

In business, staying top of mind is key. Emails and social media are a great way to get noticed, but these channels become especially challenging come the new year. These 7 tips can help ensure your email gets opened and read:

-

Will we all outlive our retirement savings? Experts say yes

The good news is that we are living longer. The bad news is that we are living longer. While it’s wonderful that medical advances are enabling us to live an average of 15-20 years more, that also means our retirement nest egg needs to stretch further. Are your clients aware of this new reality?

-

Growing a mortgage business in a soft market doesn’t have to be hard

Not surprisingly, the cool down in Canada’s real-estate market is affecting mortgage brokers across the country. Mortgage brokers in former real estate hot beds like Toronto and Vancouver have been especially hard hit. As a broker, how can you continue to grow your business in a slower market? The answer is to work a little harder and a little differently. Consider these 5 strategies for success:

-

7 mortgage trends to watch in 2019

The mortgage business is always changing. And as we kick off 2019, there are important trends that you and your team should know about so you’re not caught off guard.

-

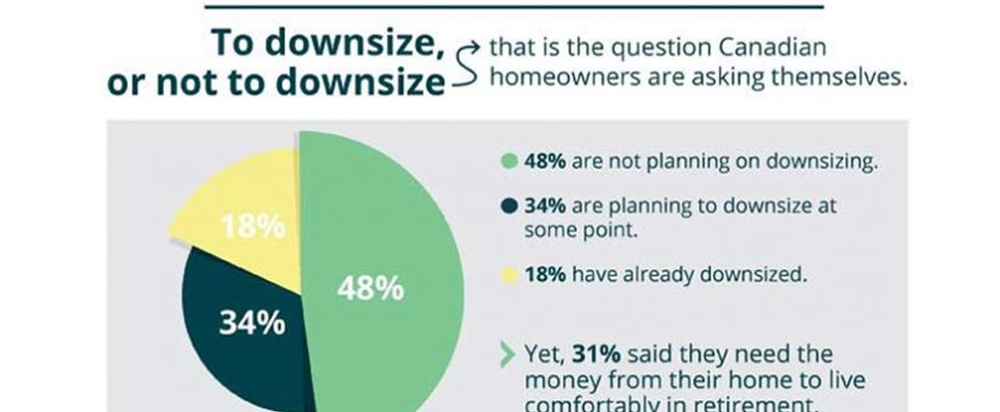

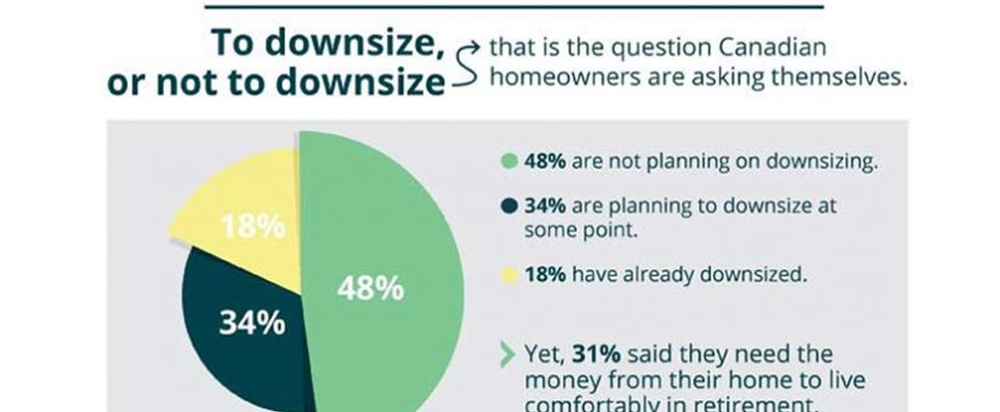

The downside of downsizing

On the surface, downsizing can make financial sense. Homeowners can use their home’s current value to purchase a smaller home that is more affordable and have money left over for retirement.

What many homeowners don’t realize (until it’s too late) is that there are many hidden costs associated with downsizing. This can ultimately leave them in a situation that isn’t what they anticipated or have to resort to moving away from their community in order to make the numbers work.

-

Your clients may be online more than you think!

If you’re not reaching out to Canadians 55+ online, you’re missing out.

Did you know that in recent years the fastest-growing demographic online are those aged 65 to 74? This demographic jumped by 16% between 2013 and 2016 according to a study by Statistics Canada. A large reason for this jump is because this demographic is comprised of the Baby Boomer generation who want to stay connected. Comparatively, the level of online usage by those aged 75+ is much lower.

-

Lessons learned during a cooling market

The real estate and mortgage market has been softening in many parts of the country and many experts are forecasting it to continue softening in 2019.

Smart mortgage brokers know how to position themselves in both hot and cool markets. So even when the market isn’t as hot as it used to be, there are opportunities for you to get the most out of the current market and embrace new technology and sales methods to expand your client base and grow your business.

-

7 marketing tools & tips… When you don’t have a marketing team

Marketing is a powerful tool that can help you acquire new leads, increase awareness, and boost your revenue. Yet the challenge most mortgage brokers have is marketing effectively without a designated marketing team.

-

The best restaurants for business meetings in Toronto, Vancouver and Montreal

We all know how tough it is to pick a quick spot to meet a client when you are already so consumed with work, making the sale and everything else in between.

The last thing you want to do is to get on Google only to scour endless pages of restaurants in the desired neighborhood. So here is a guide for restaurant and food lovers alike who are looking to impress their clients with good food, while finding that perfect meeting place to spark a great conversation and fund that deal!

-

Are online reviews costing you business?

Online reviews may be the last thing on your mind when it comes to attracting new business. However, that can be one of the easiest ways to attract new clients. This series of articles will give you the knowledge of how you can grow your business using online reviews.

-

How to respond to negative and positive online reviews

Online reviews are a crucial part of building a reputation for your business. In fact, 90% of customers read online reviews before visiting a business. If you haven’t set-up your business to receive online reviews on Google and Facebook, take a moment to read this article.

-

What we can learn about mortgage rates from the 1980’s

Whenever you read the financial section of the news, you’ll find at least one article that discusses recent rate hikes from the Bank of Canada. While there is cause for concern, in the grand scheme of things, the rates we have today are significantly lower than they were in the 1980s (which were well into the double digits).